[ad_1]

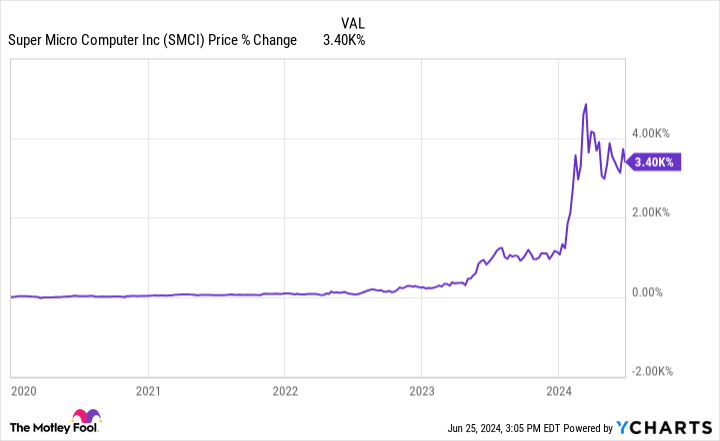

Tremendous Micro Pc (NASDAQ: SMCI) has turn out to be one of many extra dramatic and stunning corporations within the inventory market over the previous yr. The corporate existed for many years in obscurity, and its inventory gained little traction for years after its 2007 preliminary public providing (IPO).

Nevertheless, a key partnership with Nvidia has modified the sport for Supermicro (as the corporate is often known as). Consequently, its inventory is up 190% within the first half of this yr. With its huge positive factors, traders are proper to ask whether or not that momentum can proceed by means of the second half of 2024.

The state of Supermicro

Supermicro is a expertise {hardware} firm recognized for producing energy-saving, environmentally pleasant tech merchandise for the cloud, metaverse, and different functions. Its servers have gained probably the most consideration, significantly these geared up with Nvidia’s synthetic intelligence (AI) chips. Due to this partnership, its income and inventory worth have grown exponentially.

As lately as 4 years in the past, its inventory traded for about $24 per share. This yr, its current progress has been so dramatic that analysts predict almost $24 per share for Supermicro’s web earnings! Not surprisingly, such enhancements have led to a 3,400% acquire within the tech inventory‘s worth since 2020.

A Market.us research appears to substantiate this development. It predicts that the AI server trade will increase at a compound annual progress fee (CAGR) of 30% by means of 2033, reworking what was a $31 billion trade final yr into one price $430 billion by 2033.

Can the expansion proceed?

Even probably the most devoted Supermicro bulls mustn’t count on one other 3,400% acquire over the subsequent four-and-a-half years. Whereas an extra 190% acquire in six months is much from assured, that transfer is just not out of the query when one seems on the financials. Within the 9 months of fiscal 2024 (ended March 31), its web gross sales of $9.6 billion rose 95% from year-ago ranges. Its price of gross sales grew at a barely quicker 102%.

Consequently, its web earnings of $855 million grew 92% over the identical interval. Additionally, with consensus estimates pointing to a 102% enhance in web earnings for the fiscal yr, its earnings are rising quick sufficient for the inventory to take care of a speedy progress tempo.

Moreover, regardless of surging income and big inventory worth progress, its price-to-earnings (P/E) ratio is 47 and its ahead P/E ratio is 36. That is lower than a few of the faster-growing tech stalwarts equivalent to Nvidia and Amazon, indicating it might maintain the a number of expansions wanted to take the inventory worth a lot greater, presumably sufficient to take care of the present progress tempo for an additional six months.

Supermicro within the second half of 2024

Given its enterprise and monetary situations, a 190% acquire for the second half of this yr is a believable state of affairs. Admittedly, the market makes no ensures, and finally, traders mustn’t count on a 190% transfer greater by the tip of 2024.

Nevertheless, demand for the corporate’s servers is more likely to proceed rising, presumably sufficient to maintain close to triple-digit income and revenue progress for the foreseeable future.

At its present valuation, a 190% enhance within the inventory worth would give it an costly, however not record-breaking P/E ratio. Therefore, even when it falls in need of that bold aim, Supermicro might nonetheless ship vital returns for the remainder of the yr.

Must you make investments $1,000 in Tremendous Micro Pc proper now?

Before you purchase inventory in Tremendous Micro Pc, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Tremendous Micro Pc wasn’t one in all them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $757,001!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 24, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Will Healy has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon and Nvidia. The Motley Idiot has a disclosure coverage.

Tremendous Micro Pc Inventory Is Up 190% So Far This 12 months. Can the Progress Proceed within the Second Half of 2024? was initially revealed by The Motley Idiot

[ad_2]